What Happens When Tragedy Strikes At The Workplace?

Delaware Workers’ Compensation Law

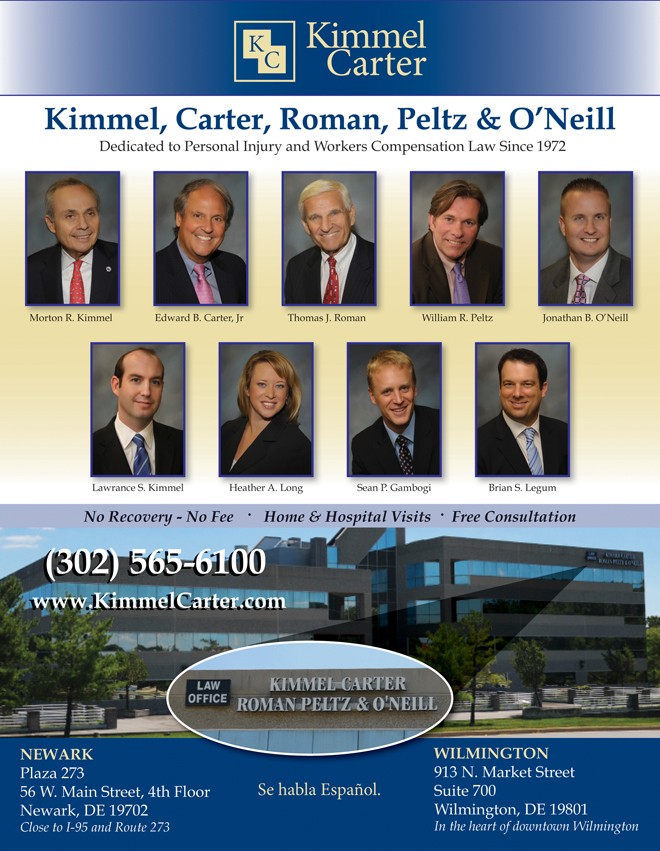

By Heather A. Long, Esq.

The New Year brought with it a new tragedy at the James T. Vaughn Correctional Center in Smyrna. We had only made it 33 days into the year, when it was reported that a group of inmates had banded together and had taken several corrections workers hostage. This was unchartered territory for Delawareans, many of whom woke up to news of the hostage situation with incredulity. Unfortunately again, the life of a hero was claimed, but not before he alerted other corrections workers to the trap lain by the inmates. It is unknown how many lives were saved that day by the fallen Corrections Officer’s warning shouts to his colleagues. This is not an easy subject to talk about, but the information is so very important to anyone trying to navigate the heart-wrenching days after losing a loved one in a work accident.

If a worker is fatally injured on the job, Delaware Workers’ Compensation laws are set up in such a way as to provide for the dependents of that worker. Usually the first benefit that will become available is for the funeral. Under Delaware laws, the deceased worker is entitled to $3,500.00 for burial expenses. This amount may be increased either by an agreement made with the Workers’ Compensation insurance carrier, or by approval from the Industrial Accident Board. Realistically speaking, the funeral home will want to receive payment before the Industrial Accident Board will have a chance to hear and decide

whether or not more money for this benefit would be appropriate. Therefore, the fastest way to guarantee that any funeral bills in excess of $3,500.00 will be paid is by making an agreement with the Workers’ Compensation insurance company. Typically, this is done through a lawyer.

Additionally, the spouse, child or children of the deceased worker may be entitled to receive benefits. The amount each receives is dependent on how many children the deceased worker had, but generally, the amount of benefits increases as the number of dependents goes up. There is a cap, or maximum amount, payable for this benefit. Usually, the benefits for the dependent children stop when the child reaches age 18, but they may be extended to age 25 as long as the child is enrolled full time in college. The spouse may continue to receive their benefits for 400 weeks, or until the spouse dies or becomes remarried.

As you can see, figuring out which family members are entitled to workers’ compensation benefits, and how much they are entitled to can be confusing and frustrating, especially while grieving the loss of a loved one. The best way for grieving families to get through the process of securing these benefits is to put everything in the hands of a lawyer who specializes in Workers’ Compensation law. This way, the family can begin the healing process while the attorney worries about securing the benefits to which the family is entitled. All of the lawyers in my firm, including myself, offer consultations for work injuries. The consultations are free, and the insight into your claim could be invaluable to your family.

Heather has been an attorney for over six years, and is currently practicing Workers’ Compensation and Personal Injury Law at Kimmel, Carter, Roman & Peltz, P.A. with offices in Newark and Wilmington. Heather worked her way through law school as a paralegal in a personal injury firm. After passing the bar exam, she spent several years working as a defense attorney, representing local, regional and national companies. With the knowledge gained about the inner-workings of these companies, she now represents injured workers and personal injury plaintiffs.

Heather is a graduate of Widener University School of Law, and the University of Nebraska- Lincoln. Prior to attending law school, she was licensed as a paramedic and spent time volunteering for her local ambulance corps. She is also active as a mock trial coach for Salesianum High School.

Heather is licensed to practice law in Delaware, Pennsylvania and New Jersey.

For more information, or to schedule a free consultation, please call (302) 565-6132 or email her directly at [email protected].