Seven Steps To Obtaining A Mortgage

Deciding to buy a house is one of the most rewarding things you will ever do. After all, there’s nothing like being able to sit back, relax in your very own living space.

Although there are many steps to take before you are able to get the keys to your starter or forever home, it can be challenging to figure out where to start in the purchasing process.

Thankfully, financial experts can help you make obtaining a mortgage feel less daunting. Here are seven steps you can take right now to get started on your home-buying journey.

1. Start saving now for a down payment

Each person’s financial situation is different, so it isn’t out of the ordinary to need to save money for several years. To make this task easier, open a separate bank account strictly devoted for building a down payment for your home purchase.

2. Determine your home-buying budget

Take some time and examine your household budget. Include all your recurring bills (such as monthly car or cell phone payments) and occasional big expenses, such as yearly insurance payments. Once you get a big-picture look at your cash flow, you will see where you can cut corners and determine how much you will be able to devote to a monthly mortgage.

3. Get your financial and personal information in order

Start gathering and organizing your financial documents. This would include federal income tax returns, bank statements, and credit card debts. Many lenders will want to see employment and salary history for at least two years. Lenders will also want to verify your identity with a government-issued photo ID and documents with residential addresses going back two years. And you will need your social security number.

4. If needed, repair your credit

Know your credit score. When you apply for a loan, you typically need to score above a certain threshold. If you find your score is low, there are ways to help your score recover. It will take time to build your score, it can’t be fixed overnight.

5. Find a Realtor® with whom you feel comfortable

Realtors® are invaluable resources during the home-buying journey. A good Realtor® can serve as a resource for a variety of financial matters, including mortgages. They can help connect you with a lender that fits your needs, and they have knowledge of what types of loans are available.

6. Research the different types of mortgage loans

All mortgage loans are not created equal. The most straightforward mortgage loan is a fixed rate mortgage, meaning the interest rate will remain the same for the duration of the loan. Adjustable rate mortgage loans, known as ARM, fluctuate over the life of the loan. Depending on certain qualifications, some people get a Federal Housing Administration (FHA) mortgage loan, or for our military personnel, a Veterans Administration (VA) loan. There are also First Time Home Buyer programs, which offer incentives to people who are ready to buy their first home.

7. Get pre-qualified, and then pre-approved, for a mortgage loan

When it is time, start by getting pre-qualified by a lender who will determine an approximate estimate of the mortgage amount for which you will be eligible.

The next step is getting pre-approved for a mortgage loan. This is more complicated, as lenders will look over your credit and financial history. By completing all the steps above, you will be ready to help the lender determine your qualifications, and have a better understanding of your personal financial picture.

Are you ready?

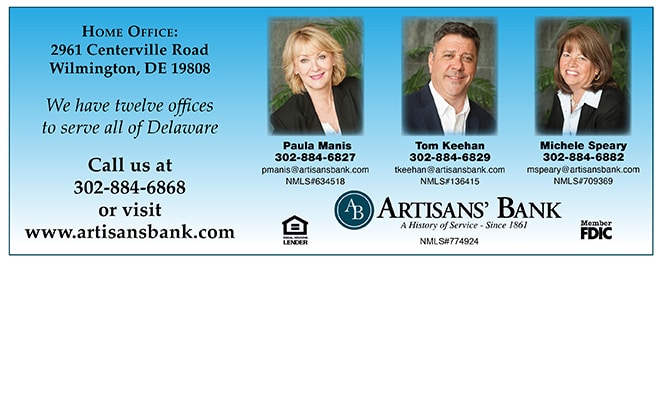

The team at Artisans’ Bank can help you find the best loan for your needs. Contact Artisans’ Bank at 302-884-6868 or visit www.artisansbank.com. With twelve offices in Delaware, they can offer you a wide selection of home lending products to meet your financial needs.