Determining Your Monthly Mortgage

Buying a house is a rewarding and life-changing commitment that comes with an often-confusing monthly mortgage payment. This payment is determined by many variables including the purchase price of the house, the amount of down payment, the term of the loan, the interest rate, required insurance, and taxes.

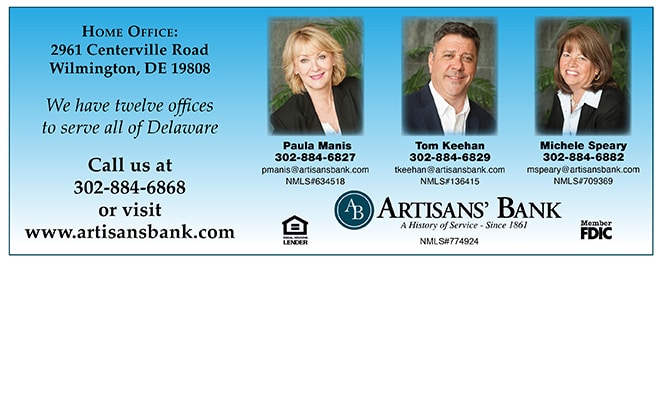

It will most likely take a nice chunk out of your paycheck for many years to come, so it’s important to work with a reputable lender like Artisans’ Bank. Here are some tips to accurately estimate your monthly payment in order to make your pursuit of homeownership less overwhelming.

Get a ballpark idea of what you can afford to spend

Before beginning a house hunt, go over your household budget. Itemize your expenses and take note of your debts, assets and other financial responsibilities. Besides giving you a ballpark idea of your monthly budget, these numbers will help you get pre-qualified for a mortgage loan.

Pre-qualification is a simple process with your lenders, where they determine how much you can borrow based on your personal financial information. This amount is not set in stone, but it will provide parameters for your home search.

Use calculator tools to get a feeling for the different options

Online calculators are a very helpful way to wrap your mind around how monthly payments are calculated and the different ways to structure home purchases. Zillow, artisansbank.com and mortgagecalculator.org offer tools to help you predict your monetary responsibilities depending on different down payments, interest rate, loan term and other factors. NerdWallet’s detailed calculator lets the user see how mortgage payments change depending on whether buyers choose 15- or 30- year fixed loans. These calculators can be a great starting point to give you an idea of what you need to budget.

Find an honest, reliable Realtor®

A trustworthy Realtor® can help steer you in the right neighborhood direction, as well as help you determine a realistic purchase price for your situation. Realtors® can also help connect you with a mortgage lender, banks, credit unions, mortgage companies or other direct lenders, all that can provide mortgages.

All mortgage loans are not created equal

Mortgage loans generally fall into two categories: fixed rate and variable rate. As the name implies, the fixed rate loans have an interest rate that does not change over the life of the loan. This ensures that you will have a steady monthly mortgage payment for the life of the loan. Variable rate loans, on the other hand, have an interest rate that can change. This means your monthly payments are less predictable and can increase, sometimes significantly.

Get pre-approved for a mortgage loan

Once you have done your homework, and you are ready to buy, it is time to get pre-approved for a mortgage loan. This process requires lenders to review your credit and financial history, and examine your financial condition, including your salary, bank account balances, credit history and debts.

The lender will be able to provide you with an approved amount you can borrow. This will help guide your home search and make you a more attractive buyer. Be aware, however, that pre-approval letters are not loan approvals and are generally only good for 60-90 days.

Are you ready to look for your new home?

Finally, your relationship with your financial institution should be a healthy one. Being able to contact a mortgage lender who knows your home buying goals, knows the local realtors and may be familiar with the neighborhood you are interested in, is a comfort through the home buying process. The expert lending team at Artisans’ Bank can offer many different types of loans and can help you determine your monthly mortgage payment. Just call them at 302-884-6868 or visit www.artisansbank.com.