Important New Changes

Relating To Delaware’s Motor Vehicle Safety Statute

By Susan D’Alonzo Ament, Esquire

The Personal Injury Group Attorneys of Morris James LLP would like to dedicate this article to educating Delaware residents on the newest amendment to Del. Code Ann. Tit. 21, § 3907 (West), which is Delaware’s Motor Vehicle Safety Statute. On September 4, 2018 Governor Carney signed House Bill 413 that is an amendment titled “[a]n Act to amend Title 21 of the Delaware Code Relating to Disclosure of Information Related to Automobile Insurance”, which will benefit Delawareans who have suffered serious personal injuries as a result of a motor vehicle accident through no fault of their own. As of the date of this article, the bill is anticipated to be signed by Governor John Carney.

What is the Purpose of This New Amendment?

Prior to this amendment, automobile insurance companies were not required to disclose liability coverage information to an injured claimant or their attorney. Liability coverage is the coverage available that an injured individual may recover from the at-fault party for their pain and suffering, outstanding medical bills and wage loss claims. Currently in Delaware, all drivers are required to carry a liability coverage of a minimum of up to $25,000 to one person involved in a single accident or $50,000 to all people involved in a single accident, with no more than $25,000 to any one person. Previously, automobile insurance companies were required to disclose this information only once a lawsuit was filed. The purpose of this amendment is to “reduce the number of lawsuits filed by requiring automobile insurance companies to disclose liability coverage information prior to the time that a lawsuit is filed.” H.B. 413. 149th Gen. Assem. Second Regular Session.

Why is This Amendment Important to Me?

The reason why this amendment is so important is because an injured individual will no longer have to incur the costs of filing a lawsuit just to obtain the information of the at-fault driver’s liability coverage. This early disclosure will also allow the injured individual or their attorney to determine whether the at-fault driver was underinsured for the accident they caused. This determination is key in that it will allow the injured individual or their attorney to proceed with additional claims under the injured individual’s own underinsured motorist coverage without the delay and extra costs that come with filing a lawsuit.

What is the Process of Obtaining Liability Coverage Information?

Under this amendment, only a Delaware attorney who represents an injured person, or an individual injured in a motor vehicle accident who is not represented by an attorney, may request that the insurer disclose the bodily injury limits of liability of any motor vehicle liability policy that may be applicable to the claim, prior to filing a lawsuit. The request must be in writing and must provide the insurer with the date of the motor vehicle accident, the name and last known address of the alleged liable party, a copy of the police report, if any, and the claim number if available. In addition, the requesting party must also submit to the insurer the injured person’s medical records, medical bills, and wage-loss documentation, pertaining to the claimed injury. Depending on the amount of medical bills and wage loss, the insurer will be required to respond within 30 days of receipt of the request.

What Can You do to Protect Yourself and the Ones You Love?

If you or your loved ones have been injured in a motor vehicle accident through no fault of your own, the Personal Injury Group Attorneys of Morris James LLP will assist you in obtaining this crucial information from the at-fault liability insurance carrier as expeditiously and efficiently as possible. The faster this information is obtained, the faster you and your loved ones can be justly compensated.

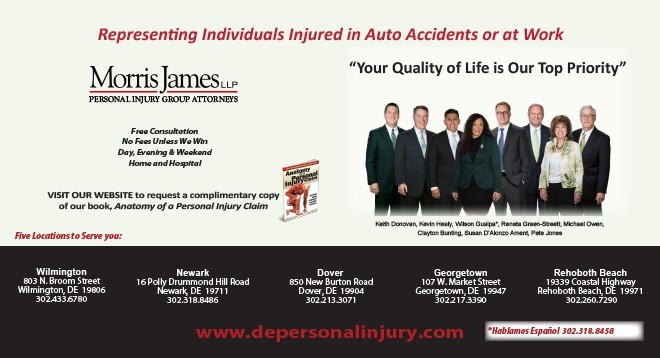

The Personal Injury Group Attorneys of Morris James LLP

The Personal Injury Group Attorneys of Morris James LLP combined have 153 years of experience in personal injury litigation and stay current on all of Delaware’s legislation affecting individuals involved in automobile accidents. If you or a loved one suffers the unfortunate event of an automobile accident, the Personal Injury Group Attorneys at Morris James LLP will guide you through the process of obtaining maximum compensation for your injuries.

Susan D’Alonzo Ament is a partner with Morris James LLP and has practiced for 33 years representing personal injury victims. Over the years, Mrs. Ament has found that some women don’t understand the crucial need to have adequate automobile insurance coverage in the event of a serious accident. Susan Ament educates women on these needs every day in her practice and in seminars that she presents throughout the year.

Susan D’Alonzo Ament is a partner with Morris James LLP and has practiced for 33 years representing personal injury victims. Over the years, Mrs. Ament has found that some women don’t understand the crucial need to have adequate automobile insurance coverage in the event of a serious accident. Susan Ament educates women on these needs every day in her practice and in seminars that she presents throughout the year.